H1: Introduction

– What Are Boom and Crash Indices?

– Importance of Understanding These Indices

H2: Fundamentals of Boom and Crash Indices

– Key Features of Boom and Crash Indices

– How These Indices Operate

H2: The Mechanism Behind Boom and Crash

– What Causes the Booms and Crashes?

– Understanding the Patterns

H2: Volatility and Trading Opportunities

– High-Volatility Nature of Boom and Crash Indices

– Capitalizing on Volatility

H2: Benefits of Trading Boom and Crash Indices

– Accessibility and Flexibility

– Unique Market Behavior

H2: Platforms and Tools for Trading

– Popular Trading Platforms

– Essential Tools for Effective Trading

H3: Analysis Techniques for Boom and Crash Indices

– Fundamental Analysis

– Technical Analysis

H2: Trading Strategies for Boom and Crash Indices

– Short-Term Trading Approaches

– Risk Management Strategies

H3: Key Indicators to Use

– Moving Averages

– Relative Strength Index (RSI)

– Bollinger Bands

H2: Avoiding Common Pitfalls

– Overtrading

– Lack of Risk Management

H2: Crafting a Trading Plan

– Setting Achievable Goals

– Staying Disciplined

H2: Risk Management Essentials

– Using Stop-Loss Orders

– Diversifying Trading Portfolio

H2: Psychological Aspects of Trading

– Managing Emotions

– Preventing Impulsive Decisions

H2: Educational Resources

– Free vs. Paid Learning Materials

– Recommended Books and Courses

H2: Advanced Trading Insights

– Utilizing Algorithmic Trading

– Leveraging Expert Advisors

H1: Conclusion

– Summary of Key Takeaways

– Encouragement to Start Trading

H2: FAQs

1. What are Boom and Crash Indices?

2. How do these indices work?

3. What strategies are best for beginners?

4. Are Boom and Crash Indices risky?

5. Where can I learn more about these indices?

Are you curious about Boom and Crash Indices? These synthetic indices are becoming increasingly popular among traders. In this blog post, we’ll dive into what they are and why understanding them is crucial for any aspiring trader.

**Key Features of Boom and Crash Indices**

Boom and Crash Indices are unique synthetic instruments designed to emulate market behavior.

They provide continuous trading opportunities without being linked to any physical assets.

**How These Indices Operate**

These indices are characterized by abrupt price spikes (booms) and steep drops (crashes). Their algorithmic nature ensures consistent and predictable patterns, making them appealing to traders.

**What Causes the Booms and Crashes?**

Booms and crashes are driven by underlying algorithms, creating sudden and significant price movements.

Understanding these patterns can help traders make informed decisions.

**Understandingy the Patterns**

Recognizing the regular intervals of booms and crashes is key to successfully navigating these indices. Traders can develop strategies based on these predictable movements.

**High-Volatility Nature of Boom and Crash Indices**

The inherent volatility of Boom and Crash Indices provides both opportunities and challenges. High volatility means rapid price movements, which can be advantageous for savvy traders.

**Capitalizing on Volatility**

Traders can leverage the high-volatility nature of these indices to secure profits. It’s essential to develop strategies that allow quick entry and exit in the market.

**Accessibility and Flexibility**

One of the main benefits of these indices is their availability for trading 24/7. This flexibility allows traders from different time zones to participate.

**Unique Market Behavior**

The distinct behavior of Boom and Crash Indices makes them an excellent choice for testing new strategies and refining existing ones.

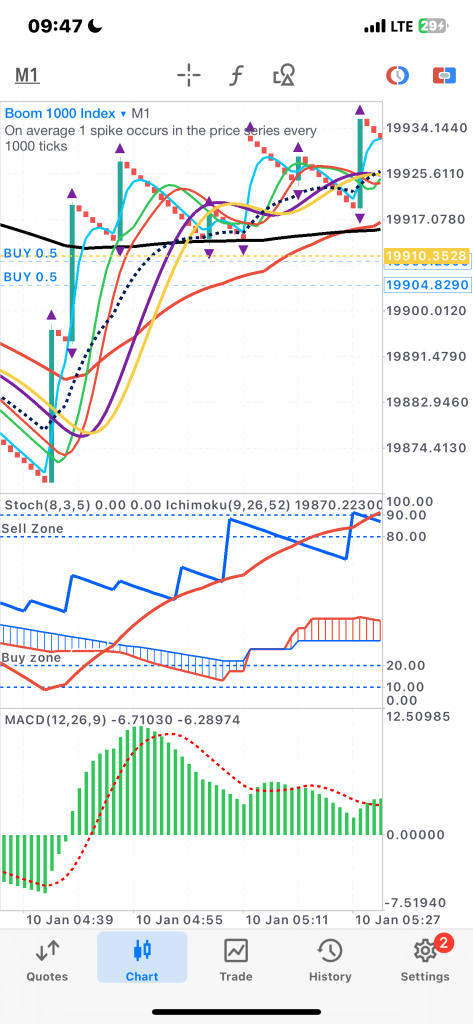

**Popular Trading Platforms**

Platforms like Deriv and MetaTrader 5 (MT5) are favored for trading Boom and Crash Indices. They offer user-friendly interfaces and advanced tools.

**Fundamental Analysis**

While fundamental analysis is less relevant for synthetic indices, it’s still useful to understand market sentiment and broader economic factors.

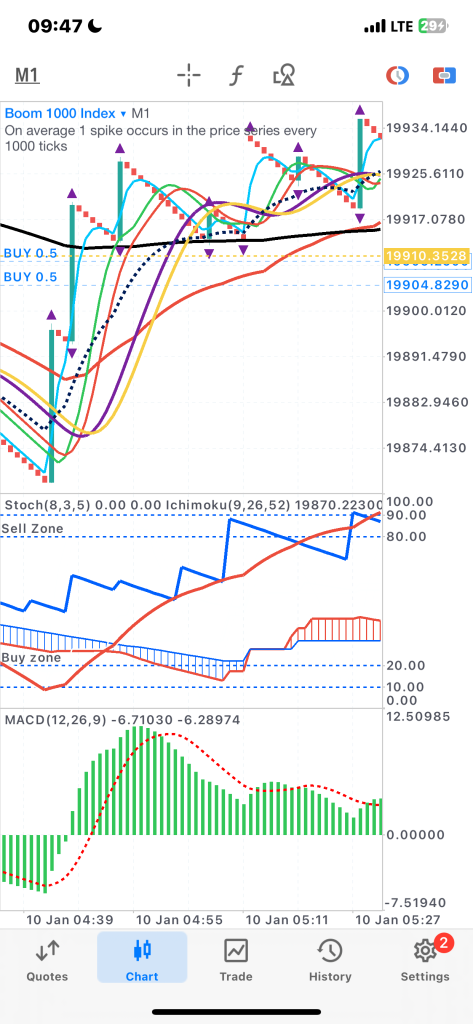

**Technical Analysis**

Technical analysis is critical for trading Boom and Crash Indices. Mastering chart patterns, indicators, and oscillators is essential for success.

**Short-Term Trading Approaches**

Short-term strategies like scalping can be highly effective. Traders can capitalize on quick price movements for consistent gains.

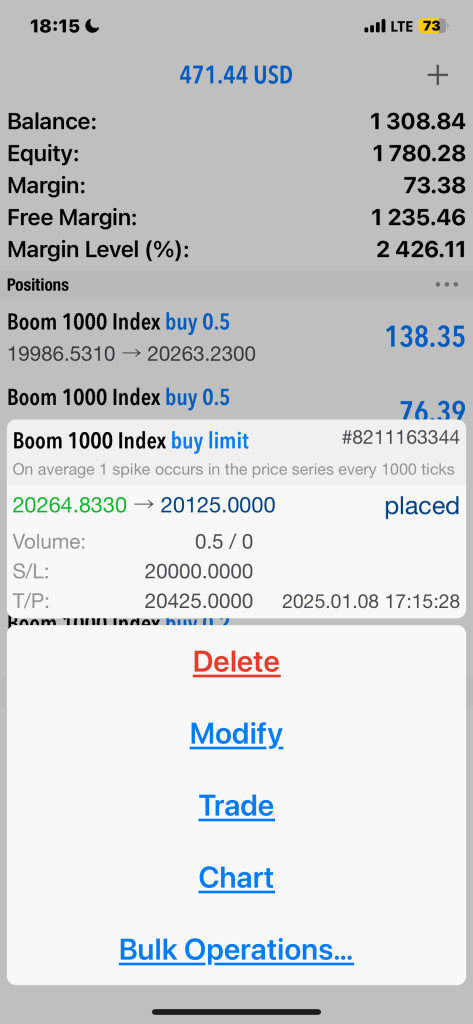

**Risk Management Strategies**

Implementing risk management strategies, such as using stop-loss orders, is crucial. Avoiding over-leverage can protect your capital.

**Moving Averages**

Help identify trends and potential reversal points.

**Relative Strength Index (RSI)**: Indicates market momentum and overbought/oversold conditions.

– **Bollinger Bands**

Measure market volatility and predict breakout opportunities.

Trying to capture every price movement can lead to losses. Focus on quality trades rather than quantity.

**Lack of Risk Management**

Neglecting risk management can result in significant losses. Always have a plan in place to mitigate risks.

**Setting Achievable Goals**

Establish clear, realistic goals for your trading activities. Avoid setting unattainable targets.

**Staying Disciplined**

Maintain discipline in following your trading plan, even during volatile market conditions.

**Using Stop-Loss Orders**

Stop-loss orders are vital for minimizing potential losses. Set them carefully to protect your investments.

**Diversifying Trading Portfolio**

Don’t rely solely on Boom and Crash Indices. Diversify your portfolio to spread risk.

**Managing Emotions**

Emotions can greatly impact trading decisions. Stay calm and focused on your strategy to avoid impulsive actions.

**Preventing Impulsive Decisions**

Take the time to analyze the market and your trades. Avoid making decisions based on emotions or gut feelings.

**Free vs. Paid Learning Materials**

Both free and paid resources offer valuable insights. Start with free materials and consider investing in paid courses for advanced knowledge.

**Recommended Books and Courses**

Books like “Technical Analysis of the Financial Markets” and online courses can provide in-depth understanding and skills.

**Utilizing Algorithmic Trading**

Algorithmic trading can automate strategies, making trading more efficient and less emotional.

**Leveraging Expert Advisors**

Expert advisors on platforms like MT5 can optimize trading activities and provide valuable market insights.

*Conclusion

Understanding Boom and Crash Indices is crucial for traders looking to capitalize on their high-volatility nature.

With the right knowledge, tools, and strategies, you can navigate these synthetic indices successfully. Ready to embark on your trading journey? Dive in and master the art of Boom and Crash trading today!

1. **What are Boom and Crash Indices?**

Synthetic indices designed to simulate high-volatility market movements.

2. **How do these indices work?**

They operate based on algorithms that create sudden price spikes and drops.

3. **What strategies are best for beginners?**

Scalping and swing trading with a focus on risk management are ideal for beginners.

4. **Are Boom and Crash Indices risky?**

Yes, but with proper strategies and risk management, the risks can be mitigated.

5. **Where can I learn more about these indices?**

Explore online courses, tutorials, and platforms like Deriv and MT5.

Unlock the secrets to mastering Boom and Crash Indices with these expert tips. Learn key strategies, risk management techniques, and insights to enhance your trading skills and achieve success.

Explore high volatility trading with Boom and Crash Indices. This guide covers essential strategies and risk management, perfect for beginners eager to learn and succeed.